The Mark of FDI and the Aspiration of Vietnamese Entrepreneurs

Foreign Direct Investment (FDI) has been one of the most transformative forces behind Vietnam’s economic success story. Over the past 35 years, FDI has fueled industrial growth, generated millions of jobs, and helped Vietnam emerge as a reliable player in global supply chains. Yet, in today’s competitive era, the challenge lies not only in attracting FDI but also in enabling Vietnamese business to grow stronger so that foreign investors evolve from being “capital providers” into true development partners.

FDI’s Vital Role in Vietnam’s Economic Transformation

Vietnam’s journey with FDI began in the early 1990s with small-scale, labor-intensive projects. At that time, most enterprises focused on low-cost assembly and simple processing. Today, the picture looks very different: Vietnam is now home to advanced manufacturing facilities that produce electronics, automobiles, and high-value exports for global markets.

- FDI stock: USD 519.5 billion (as of June 2025), compared with just USD 1.3 billion in 1991.

- Contribution: 18–20% of Vietnam’s total social investment, more than 5 million jobs, and over 70% of export turnover.

- Industrial impact: The arrival of global giants like Toyota, Honda, and Samsung has not only transformed industries but also created space for local players such as VinFast, Thaco, and Thành Công to scale into regional and global competitors.

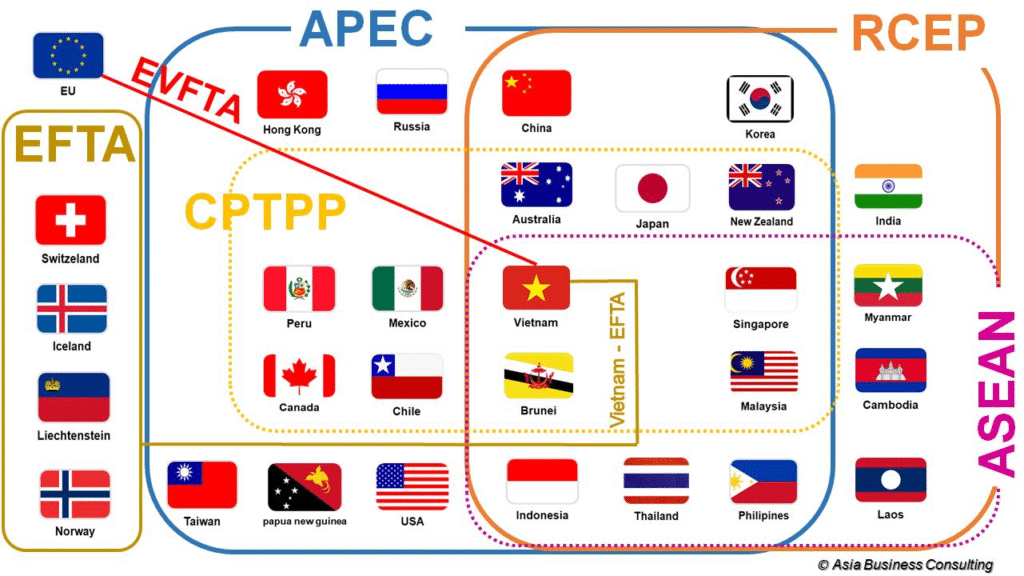

As the largest contributor to exports, FDI enterprises have also helped Vietnam integrate broadly and deeply into international trade. The increasing presence of FDI enterprises contributes to promoting Vietnam’s participation in many free trade agreements (FTAs) and joining many international economic organizations.

With 17 free trade agreements that Vietnam is signing and in effect, domestic and FDI enterprises have the opportunity to access more than 60 economies, accounting for nearly 90% of global GDP. This not only helps Vietnam have the opportunity to successfully transform its economic structure, but also allows us to plan the development of a number of key industries in the development trend of the world.

The mark of FDI entrepreneurs

“Over the past two decades of working with FDI entrepreneurs, I have gained valuable lessons in corporate governance and long-term strategy, while also sharing insights into Vietnam’s business culture.” said by C+’s Managing Director – Mr Colin Ngo.

One of their most important contributions has been in management culture and compliance. With access to advanced governance models and standardized processes, FDI leaders have helped Vietnamese entrepreneurs adopt best practices a “soft transfer” as valuable as capital investment. Their influence also extends to regulatory reforms, from the Enterprise and Investment Laws to the more recent Personal Data Protection Law, alongside introducing ESG and sustainability standards.

At the same time, many foreign entrepreneurs have adapted to Vietnam by learning the language, engaging with communities, and aligning their businesses with local society. This two-way integration has enabled Vietnamese private enterprises to mature through collaboration gaining exposure to global systems, measurable development models, and long-term strategic planning.

In my own work in investment consulting, we continuously benchmark against multinational corporations operating in Vietnam, studying how they evolve and adapt to disruptions such as artificial intelligence. This inspires us to refine our own strategies and ask: How can we reach their level of development within the next 5–10 years?

Vietnamese businesses need to be given more opportunities

From the perspective of Vietnamese entrepreneurs, true partnership with FDI enterprises requires balance both sides must stand on relatively equal ground. Resolution 68-NQ/TW marks a historic chance for domestic businesses to grow stronger and expand internationally, but beyond supportive mechanisms, they also need access to national projects and joint ventures.

In fields like investment consulting, criteria should be established so that domestic firms – 95% of which are SMEs can collaborate with foreign groups. Similarly, public projects should be structured to allow SME participation, while policies must also extend support to service exports, not only goods.

Policies should also promote both goods and service exports. While key products receive state support, service exports remain overlooked — even though they also bring foreign currency to the country. Many nations already provide strong incentives for both sectors.

As local businesses grow, FDI investors can shift from being “capital providers” to development partners, viewing Vietnamese firms as collaborators. Increasing local-content requirements for Certificates of Origin (C/O) also encourage closer cooperation between FDI and domestic companies.

Although FDI capital always seeks the best returns, building lasting ties both with FDI executives and their companies is essential. Stronger relationships will help Vietnamese firms become trusted partners, use FDI networks to expand abroad, and even act as investors in new markets, aligning with Resolution 68 on private sector development.

Leave a Reply