VIETNAM FDI H1 2025: USD 11.7 Billion Disbursed Capital, the Highest Figure in Five Years

In the first half of 2025, Vietnam reaffirmed its position on the global investment map, maintaining strong appeal despite ongoing global economic uncertainties. According to the Ministry of Finance (MOF), total foreign direct investment (FDI) inflows reached USD 21.52 billion, a 32.6% increase year-on-year. Notably, disbursed capital was estimated at USD 11.72 billion, up 8.1%, marking the highest H1 disbursement level since 2021.

Strong growth in both capital adjustments and equity contributions

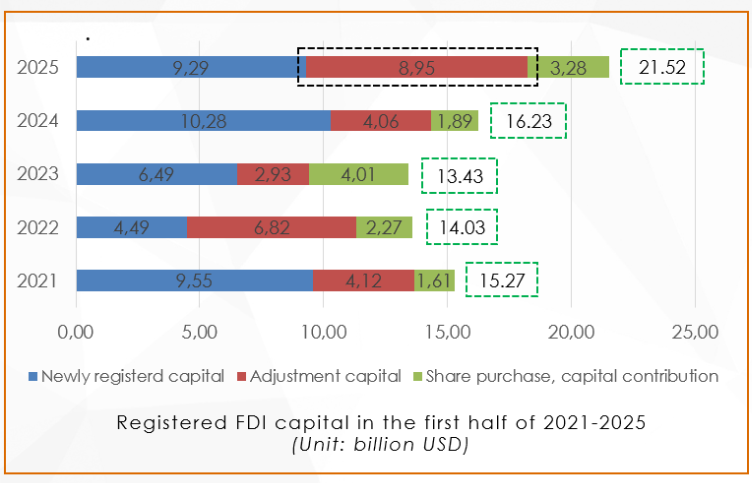

In the total registered foreign investment capital in the first half of the year, Vietnam witnessed the strong growth of capital adjustments and share purchase and capital contribution. It indicates that the country remains its attractiveness to foregn investors amid the rising fears of global free trade. In details,

- Newly registered capital reached USD 9.29 billion, a slight decline in value, yet the number of new projects surged to 1,988, up 21.74% year-on-year.

- Adjusted capital reached USD 8.95 billion, up a remarkable 120.5%, the highest mid-year figure since 2020.

- Capital contributions and share purchases rose 73.6%, totaling USD 3.28 billion.

Significantly, there were 826 capital expansion projects, up 31.11%, outperforming both new project growth (21.74%) and share purchase transactions (7.56%). This trend reflects strong investor confidence and long-term commitment to the Vietnamese market.

Manufacturing and real estate remain top sectors

Among 18/21 economic sectors receivin FDI in H1, Manufacturing and processing sector led the top, followed by real estate business.

- Manufacturing and processing continued to lead with USD 11.97 billion, accounting for 55.6% of total registered capital, up 3.9% year-on-year.

- Real estate business ranked second with 24% of total FDI, doubling its share compared to the same period last year.

- The professional, scientific activities followed, attracting USD 1.18 billion (5.47%), while water supply and waste treatment saw a notable increase to USD 902.9 million.

In terms of the number of projects, manufacturing and processing dominated with 38.2% of new projects and 56.5% of capital adjustments. Meanwhile, wholesale and retail topped in capital contribution and share purchase activities, accounting for 40.9%.

Traditional investors maintain top rankings

- Singapore remained the top investor, with USD 4.6 billion, representing 21.4% of total FDI.

- South Korea ranked second with USD 3.08 billion, doubling its investment from the same period last year and accounting for 14.32%.

- China, Japan, and Malaysia followed in terms of investment value.

In terms of the number of projects, China led with approximately 600 new projects, accounting for over 30%; South Korea ranked first in both capital adjustments (18.5%); share purchase, capital contribution (26.5%), reflecting dynamic and multi-dimensional investment strategies.

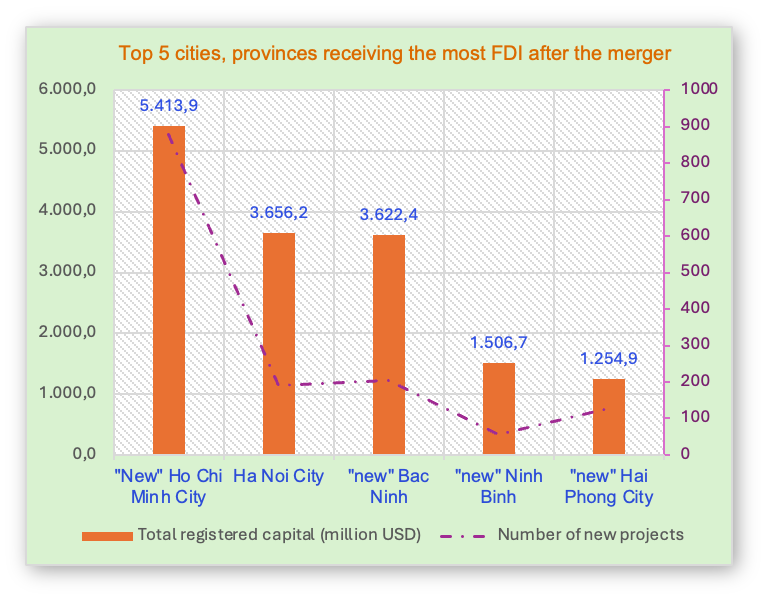

Top attractive locality to FDI in H1 named Ha Noi

Hanoi led with nearly USD 3.66 billion in registered capital, accounting for 17% of the national total – a 183% increase over the same period last year. Bac Ninh came second with USD 3.15 billion (14.6% of the total), up 7.1%. Ho Chi Minh City (old) ranked third with USD 2.7 billion, making up 12.6%, more than doubling its performance year-on-year.

However, after administrative mergers, this order has shifted, the newly defined “Greater HCMC” area (“old” Ho Chi Minh City, Dong Nai, and Ba Ria – Vung Tau) rose to the top in total FDI attraction. Other restructured localities such as Hanoi, Bac Ninh, Hai Phong, and Ninh Binh also ranked among the most attractive destinations for foreign capital.

C+ Consult. has compiled a comprehensive FDI report quarterly featuring in-depth statistics, visual charts, and multi-dimensional analysis by sector, investment partner, and location — tailored for businesses exploring expansion and investment opportunities in Vietnam. In the Report, part 1 records the FDI figures of the first six months of Vietnam. Part 2 introduces preferable conditions of “New” Ho Chi Minh City after the administrative merger.

Should you need it, register below to download

Vietnam FDI Report H1/2025 by C+ Consult.

Pingback: Elevating Vietnam RoK Strategic Partnership Through Investment and Innovation